Fantastic credit score, a reduced DTI ratio along with a steady source of revenue can all allow you to protected a small APR. But even When you've got much less-than-best credit history, you may nonetheless protected An easily affordable loan by picking a lender that focuses on good or terrible credit rating loans or by applying using a co-borrower or co-signer.

Read the wonderful print with all your preapproval to make sure it will not influence your credit score score or compromise your personal facts.

Look out for: It really is value noting Wells Fargo's background with details stability and compliance. The bank has confronted various federal penalties for improper customer referrals to lending and insurance coverage solutions, and security concerns related to making fake accounts a number of many years ago.

APR: Your loan APR contains not only the desire but will also other expenses billed through the lender. Due to this, you’ll get a far better notion of how lenders Evaluate by taking a look at the APRs as opposed to only the curiosity premiums.

Bankrate.com is an independent, advertising and marketing-supported publisher and comparison support. We are compensated in exchange for placement of sponsored products and services, or by you clicking on sure inbound links posted on our web-site. Therefore, this compensation may impact how, exactly where and in what order items surface inside of listing classes, other than where by prohibited by law for our mortgage loan, household fairness along with other home lending goods.

Business enterprise costs are described by the IRS as fees connected to forming or functioning a company. The interest that's associated with the loan taken out to type or run your enterprise could possibly be deductible, regardless of the dimension of your enterprise.

Our editors are dedicated to bringing you impartial rankings and information. Our editorial content material just isn't influenced by advertisers.

Frequently, the extended the term, the greater desire is going to be accrued as time passes, increasing the total expense read more of the loan for borrowers, but minimizing the periodic payments.

Nonetheless, Update doesn’t disclose the quantity of these bargains unless there is a registered account. The lender also rates an origination charge and also costs for late and returned payments, which might improve your All round borrowing charges.

An vehicle loan is often a secured loan accustomed to buy a car. The vehicle loan calculator helps you to estimate month-to-month payments, see exactly how much full fascination you’ll shell out and also the loan amortization program.

We use details-driven methodologies To guage fiscal merchandise and corporations, so all are measured Similarly. You may read more details on our editorial rules as well as loans methodology for that ratings down below.

HELOCs normally provide variable desire fees, which often can make regular payments challenging to control and budget eventually

Three times ahead of the scheduled closing date within your property finance loan, the lender ought to give the closing disclosure. This legal doc offers the ultimate conditions with the loan plus the complete closing prices.

Like all lender, Upstart considers credit scores as Element of the procedure. But In addition, it considers work historical past and training history, which include in which you went to school and also your location of study.

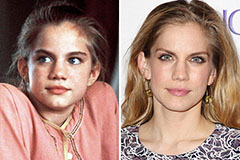

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now!